When it comes to taxes, the ultra-wealthy don’t just pay accountants — they pay strategists. Over the years, rich individuals and businesses have mastered a variety of tactics to legally reduce how much they owe to the government. One of the most clever (and widely used) is the “double company” trick.

Sounds like something out of a spy movie, right? But it’s very real. And while it might seem complicated on the surface, it’s actually a brilliant (and totally legal) tax strategy — one that anyone interested in business or finance should understand.

Let’s break it down, human-to-human, so it actually makes sense.

What Is the “Double Company” Trick?

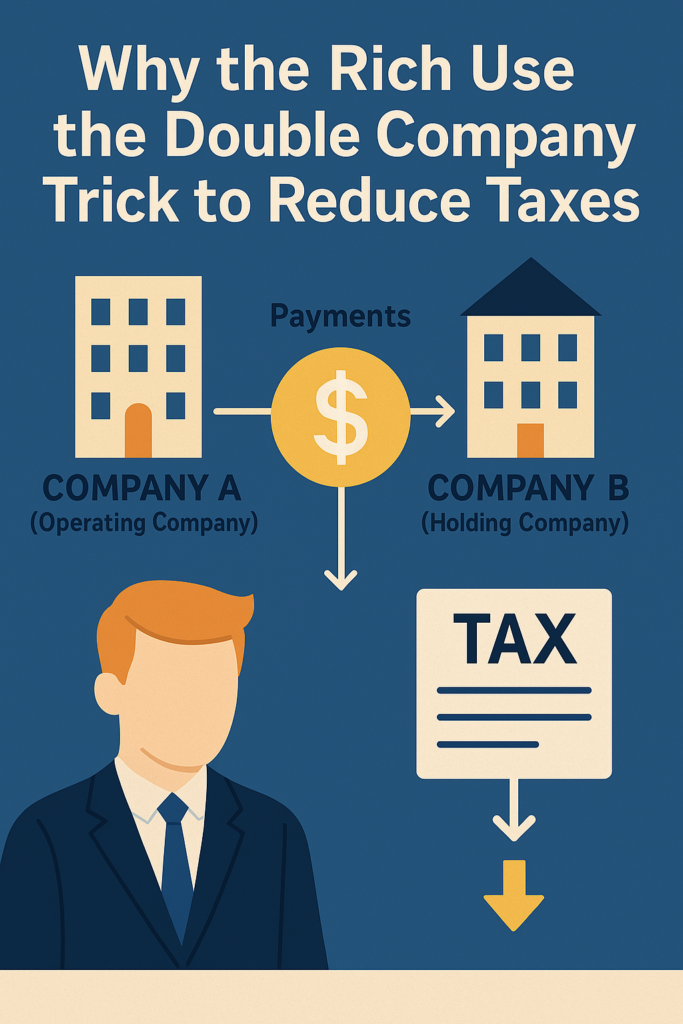

The double company trick is when a wealthy person sets up two separate companies — each serving a unique purpose. The goal? To shift income and expenses in a way that minimizes taxable profits.

It typically works like this:

- Company A is the “Operating Company” — it actually sells products or services and brings in revenue.

- Company B is a “Holding Company” or a second business that owns assets, trademarks, or provides consulting, management, or other services to Company A.

The trick comes in how money moves between these two. Company A pays Company B for services like “consulting,” “management,” “intellectual property,” or even “rent.” This reduces the profit of Company A — which means less taxes on its end.

But guess what? Company B receives that money — often in a more tax-friendly jurisdiction or with more flexible write-offs.

A Real-World Example (In Simple Terms)

Let’s say Sarah runs a successful online clothing store (Company A) that earns $500,000 a year in profit. Without any structure, she might be taxed 30% on that income — which is $150,000 in taxes. Ouch.

So, Sarah sets up Company B — let’s call it a “Consulting & Brand Management” firm. Now, Company A pays Company B $200,000 a year for “brand licensing,” “marketing,” or “consulting” services.

Company A’s taxable income is now only $300,000, and Company B receives $200,000. If Company B is in a low-tax state or country, or if Sarah pays herself in dividends or reinvests wisely, she can drastically reduce her total tax bill.

End result? She might save tens of thousands of dollars legally.

Why the Rich Love This Strategy

There are a few reasons why this trick is especially loved by wealthy entrepreneurs, investors, and corporations:

1. Control Without Complexity

They control both companies — so they control where the money goes. It’s not fraud; it’s structure. And the IRS knows it exists — they just require it to be reasonable and well-documented.

2. Flexibility Across Jurisdictions

Company B can be based in a tax-friendly country (like Ireland, the UAE, or Singapore) or a U.S. state with low taxes (like Wyoming or Delaware). This opens doors to further optimization.

3. Write-Offs and Loopholes

By shifting profit to Company B, the rich can stack more write-offs — from business expenses and depreciation to R&D credits and employee benefits.

4. Asset Protection

It also separates assets. If Company A is ever sued, Company B’s assets are usually protected, because it’s a separate legal entity. That’s smart risk management.

Isn’t This… Shady?

Not really — as long as it’s structured properly and used legally, this method is 100% above board. Big corporations do it all the time. Just Google “Double Irish with a Dutch Sandwich” — that’s how companies like Google and Apple avoided billions in taxes for years.

But yes, it can be abused. If the companies are fake, the services aren’t real, or the pricing is way off (known as “transfer mispricing”), tax authorities can come knocking. That’s why the rich don’t just do this alone — they use experienced tax advisors and corporate lawyers.

Can Regular People Use This Strategy?

You don’t have to be a millionaire to use the double company approach. In fact, many small business owners already do — especially in consulting, content creation, real estate, or e-commerce.

For example:

- A freelancer might open one LLC for their work and another for managing personal brand deals or intellectual property.

- A YouTuber could split income between a media company and a merchandise company.

- A real estate investor might use one LLC for management and another for holding assets.

It all comes down to income size, business type, and willingness to set things up right.

Final Thoughts

The rich don’t pay fewer taxes because they cheat — they pay fewer taxes because they understand the game. The double company trick is one of many smart, legal ways to optimize taxes, protect assets, and build generational wealth.

If you’re building a business or thinking long-term about money, it’s worth learning how these structures work. And who knows? One day, you might be the one saving six figures — just like Sarah.

Knowledge is power. And when it comes to money, knowledge saves taxes.

A: The double company trick is a tax strategy where an individual sets up two businesses — one for operations and one for services or assets — to reduce taxable income legally.

A: Yes, it is legal when properly structured and documented. It is widely used by wealthy individuals and corporations to optimize taxes.

A: Absolutely. Freelancers, e-commerce sellers, and content creators can all benefit from this method with the right setup and guidance.

A: Depending on income and location, the double company strategy can save tens or even hundreds of thousands in taxes annually.

A: The main risk is misuse or poor documentation, which can trigger audits. It’s best to work with a professional accountant or tax advisor.